MCG's new book " Winning Investment: Code to Fortune-VMMIG Model" officially out now

——--The first purchasers of the book will have the opportunity to get a signed and stamped copy of the book signed by the author!

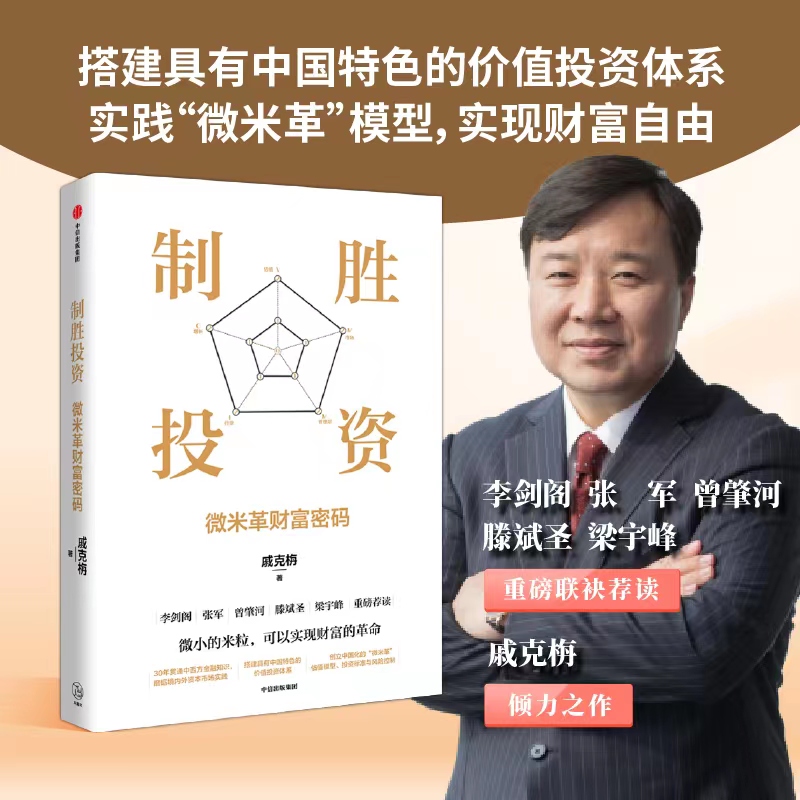

In April 2023, MCG founder Dr. Qi’s new book, “Winning Investment: VMMIG - the code to Wealth” was officially published by Citic Publishing House. This is a heavyweight financial book launched by Citic Publishing House, one the most renowned publishing houses in China, in 2023. Previously, Dr. Qi translated the book “Merger Masters: Tales of Arbitrage”, which was selected by Tencent News, CITIC Publishing House and Zhanlu Culture as "2020 Top Ten Influential Books in the Financial Field" in 2020. “Winning Investment: VMMIG – The Code to Wealth” is jointly recommended by Chairman of the Sun Zhifang Foundation, former deputy director of the Development Research Center of the State Council, former vice chairman of the China Securities Regulatory Commission, former chairman of CICC, and renowned economist Li Jiange; Dean of the School of Economics of Fudan University, renowned economist Zhang Jun; Former deputy general manager, chief accountant and general counsel of China State Construction Group Zeng Zhaohe; Deputy dean of Cheung Kong Graduate School of Business and famous strategy professor Teng Binsheng; And former director of Orient Securities Research Institute, founder of Yi Research, author of "Long-Term Power" and "The Power of Common Sense" Liang Yufeng.

The book used the author’s experience in Chinese and Western financial education and capital market practice of 30 years to explore an investment system with Chinese characteristics and build the easy-to-understand/useful “VMMIG” valuation model, stock selection criteria and risk control ideology that corresponds to Chinese features.

The purpose of the book is to serve the people and become a classic teaching material of “People’s Finance” that can educate and be passed down by the general public. By digging out the highlights of Western value investment concepts that are in line with China's national situation and Chinese culture, the book helps the general public of China to establish long-term and non-opportunistic investment concepts from the perspective of long-term investment accumulation and accomplishment of wealth revolution, so they can accomplish true freedom of wealth through the accumulation of compound interest income.

The first chapter “Story of a tiny grain of rice” talks about the ideology of value investment. It starts with the fable of the fisherman and the king, and explains in detail the magic wand of compound interest, three-part theory, Chinese public’s misunderstandings about value investment, the idea that investment is to invest in the fortune of the country, and how to invest across cycles.

From the second to the sixth chapter, the book discusses a value investment system and methodology with unique Chinese characteristics. It elaborates on the “VMMIG Model” from five dimensions: Valuation, Market, Management, Industry, and Growth.

In the second chapter, starting with the valuation of Chinese companies, the book provides a step-by-step guide for investors to find relevant data from the vast amount of financial ad business information, establish valuation models, and anchor the true value of the companies. The third chapter discusses predicting the medium to long-erm macroeconomic and capital market trends in China, analyzing factors such as monetary policy, fiscal policy, and unexpected events that influence short-term markets. The fourth chapter starts with motivational theory, analyzes human nature, and sets standards for the “Five Haves” management level in China. It analyzes management characteristics from the perspectives of China’s unique forms of listed companies, regions, eras, and internationalization. The fifth chapter establishes the underlying logic of industry analysis from the dimensions of society, world, and time. It analyzes, extracts, and summarizes the major trends in China known as the “Nine Major Trends and provides examples of analysis in cutting-edge fields of competition among major nations and the chip industry, the “foundation” industry of ChatGPT. The sixth chapter analyzes the impact of growth on valuation, the contribution of competitive advantage “moats” to growth, and the power of capital.

The seventh chapter, “VMMIG – The Code to Wealth”, discusses the scoring system of VMMIG, the value investing model with Chinese characteristics. It provides examples for scoring for 60 companies in 20 segmented industries and elucidates the crucial risk control concept of VMMIG.

If you are interested in purchasing this book, please contact Ms. Yu

(cell phone number/WeChat number: 18710061706) for a favorable price.

The company has a small number of Dr. Chi's signed and stamped edition, pre-order quickly!